Tremendous Micro Pc (NASDAQ: SMCI) and Intel (NASDAQ: INTC) have been within the limelight over the previous 12 months or so due to the power of each corporations to capitalize on the booming demand for synthetic intelligence (AI) chips. However a better have a look at the inventory worth efficiency of each corporations tells us that buyers are closely favoring certainly one of them over the opposite.

Whereas share costs of Tremendous Micro Pc (doing enterprise as Supermicro) have jumped a surprising 776% prior to now 12 months, Intel has recorded comparatively modest however strong good points of 71%, outpacing the PHLX Semiconductor Sector index’s 57% good points. Supermicro inventory’s excellent surge has introduced its market cap from $5 billion a 12 months in the past to greater than $48 billion as of this writing.

Intel’s market cap, however, has elevated from $104 billion a 12 months in the past to $181 billion as of this writing. Supermicro, subsequently, has loved a a lot greater surge in its market cap prior to now 12 months. However can it proceed to outpace Intel on the inventory market and grow to be an even bigger firm when it comes to market cap by 2027? Let’s discover out.

Tremendous Micro Pc expects to develop at a sooner tempo than Intel

A giant motive why the market has rewarded Supermicro inventory with eye-popping good points is due to the terrific progress within the firm’s income and earnings. A better have a look at the chart under exhibits that Supermicro considerably outpaced Intel’s top- and bottom-line efficiency.

A better have a look at the most recent monetary outcomes of each corporations exhibits why buyers have been piling into Supermicro inventory. The booming demand for AI chips turned out to be an even bigger tailwind for Supermicro when in comparison with Intel. That is as a result of Supermicro’s server rack options permit information heart operators to economically deploy AI accelerators in a manner that they will scale back cooling and electrical energy prices whereas conserving efficiency at optimum ranges.

It’s value noting that Supermicro’s AI server options are used for mounting AI chips from Intel, Nvidia, and Superior Micro Units. So, it would not matter which of those chipmakers is promoting extra AI chips as a result of information heart operators are fairly more likely to flip to Supermicro for its modular server options. The corporate subsequently sees strong progress in its income but in addition should aggressively put money into capability growth.

Supermicro’s income within the second quarter of fiscal 2024 (ended on Dec. 31, 2023) greater than doubled on a year-over-year foundation to $3.66 billion. The corporate anticipates $3.9 billion in income within the present quarter on the midpoint of its steering vary, which might be 3 times its income from a 12 months in the past.

So, Supermicro’s progress is all set to step on the gasoline within the present quarter. Moreover, the corporate expects to complete the 12 months with $14.5 billion in income as in comparison with income of $7.1 billion in fiscal 2023. That might be a big improve over the $7.1 billion in income it generated within the earlier fiscal 12 months.

Intel, however, hasn’t been capable of capitalize on the AI chip growth but as a result of this market is presently being dominated by Nvidia. Intel’s income within the fourth quarter of 2023 was up 10% 12 months over 12 months to $15.4 billion, whereas its full-year income fell 14% to $54.2 billion due to the weak point within the private pc (PC) market.

It’s value noting that Intel’s AI-related income pipeline stands at over $2 billion, in keeping with administration’s feedback on the January earnings convention name. Supermicro, in the meantime, will get greater than half its income from promoting AI server options. So, AI is driving progress in a extra significant manner for Supermicro, and its enterprise is rising at a a lot sooner tempo in consequence.

Extra importantly, Supermicro is growing its manufacturing capability and believes that its efforts may assist improve its annual income capability to $25 billion. That might be almost double the corporate’s income forecast within the present fiscal 12 months. It will not be shocking to see Supermicro hitting that concentrate on over the following three years because the demand for AI servers is anticipated to extend fivefold between 2023 and 2027.

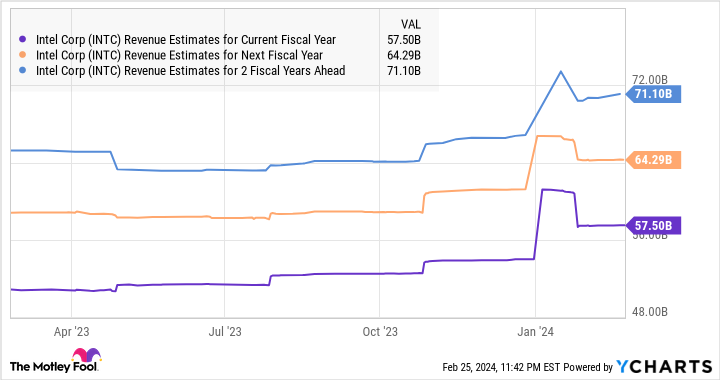

Assuming Supermicro achieves $25 billion in income in fiscal 2026, its three-year income compound annual progress price (CAGR) would stand at 52%, utilizing the fiscal 2023 income of $7.1 billion as the bottom. Intel’s income, however, is anticipated to extend at a a lot slower tempo of 6% within the present fiscal 12 months to $57 billion, adopted by double-digit will increase in 2025 and 2026.

Nonetheless, will Supermicro’s sooner progress assist it grow to be an even bigger firm than Intel?

Can Chipzilla be overtaken by Supermicro?

Assuming Supermicro certainly generates $25 billion in annual income inside the subsequent three years and maintains its present price-to-sales ratio of 5.4 at the moment, its market cap may improve to $135 billion. That might be virtually 3 times the corporate’s present market cap. Intel, in the meantime, is presently buying and selling at 3.4 instances gross sales. An identical gross sales a number of after three years would carry its market cap to $242 billion, a leap of 33% from present ranges.

So, Intel is more likely to stay the larger firm after three years, however it’s value noting that Supermicro has the potential to ship a a lot stronger upside to buyers. Supermicro is not all that costly when in comparison with Intel so far as the gross sales a number of is worried, particularly contemplating the eye-popping progress it’s delivering. So it might be a good suggestion for buyers to purchase Supermicro as a result of it has the potential to maintain its rally and stay a red-hot progress inventory.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Tremendous Micro Pc wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Intel and Tremendous Micro Pc and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and brief February 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Will Tremendous Micro Pc Be Price Extra Than Intel by 2027? was initially revealed by The Motley Idiot